Menu

SHS is a leading investment firm based in the Emirate of Dubai, specializing in driving strategic investments across diverse, high-potential sectors in emerging global markets. Built on a strong foundation in oil and natural gas projects, we have evolved to target a wide range of industries that contribute to sustainable economic growth and development.

Our portfolio encompasses energy enterprises and management, where we advance innovative solutions in the energy sector, and industrial enterprises and management, focusing on projects that propel industrial advancements and infrastructure growth.

We invest in high-potential sectors with a commitment to long-term value creation.

Our strategy balances financial returns with environmental and social considerations.

We are also dedicated to water enterprises and development, addressing critical global needs for sustainable water resources, as well as commercial enterprise management, supporting businesses that fuel economic progress. SHS places strategic emphasis on sports enterprise development, enhancing sports infrastructure and community engagement, and healthcare enterprise development, driving innovation and accessibility in medical infrastructure and services to improve health outcomes.

Additionally, our investments in agriculture enterprise management support initiatives that strengthen food security and sustainable farming practices, while our focus on educational enterprise management fosters access to quality education and knowledge-based development. Retail trade enterprises and management form another vital area of interest, enabling businesses to meet market demands and enhance consumer experiences. Finally, our commitment to tourism enterprise management reflects our vision for promoting regional and international tourism, with investments in hospitality infrastructure, cultural development, and sustainable travel initiatives.

At SHS, we combine a legacy of financial excellence with a forward-thinking approach to responsible and sustainable growth. Our investment philosophy prioritizes balanced financial returns while upholding environmental and social considerations. By expanding our global footprint across these sectors, we aim to create lasting value for stakeholders and make a positive impact on the communities and regions we serve. This vision reflects our heritage, dedication to excellence, and commitment to fostering long-term, sustainable development.

SHS was established by two sisters of the Abdul Aziz Emirate. Shamma Rashed Abdulaziz and Hessa Rashed Abdulaziz are granddaughters of Abdul Aziz Al Ghurair.

Shamma and Hessa are shaped by backgrounds characterized by rigorous education and extensive exposure to the global dynamic business environment. They embody a powerful legacy of excellence and ambition and bring a unique blend of educational excellence and hands-on business experience to their roles as leaders of SHS. Driven by a shared passion for value creation, Shamma and Hessa envision SHS as a transformative force in the world of energy investment.

"Our mission is to lead with purpose and precision, bringing a bold, fresh approach to energy investment. With SHS, we are crafting a legacy that goes beyond financial returns.

We are driven by a passion to redefine investment as a force for resilience and growth in emerging markets — an investment that honors the past, enriches the present, and shapes a sustainable future”

Shamma Rashed Abdulaziz

"Every investment we make is rooted in a commitment to excellence, adaptability, and innovation. We envision a future where our work fuels progress, not only for the markets we invest in but for the world we aspire to uplift.

We aim to leave an impact that will resonate through generations, transforming challenges into powerful stories of growth and achievement”

Hessa Rashed Abdulaziz

The African continent has emerged as a focal point for foreign direct investment (FDI), particularly from the United Arab Emirates (UAE) and other Middle Eastern nations. As the fourth largest investor in Africa over the past decade, the UAE has significantly influenced various high-growth sectors, positioning itself strategically alongside competitors such as Saudi Arabia and Qatar.

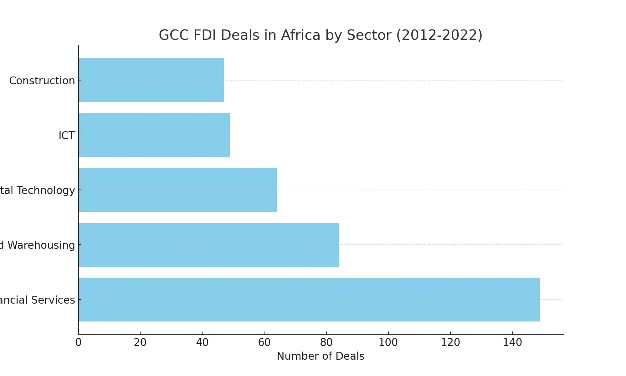

According to reports, the combined FDI from the Gulf Cooperation Council (GCC) states amounted to approximately $101.9 billion between 2012 and 2022, with the UAE contributing $59.4 billion, making it the leading investor in Africa. The primary sectors attracting this investment include

In 2021 alone, UAE firms engaged in 71 projects valued at $5.6 billion, emphasizing their commitment to enhancing agricultural productivity in Egypt through innovative projects like the Agtech Park.

Furthermore, public and private entities, including Infinity Power, AMEA Power, and Masdar, have entered into multiple agreements for renewable energy projects across Africa.

Investment pledges made by the UAE have escalated dramatically, reaching approximately $97.3 billion in total for 2022 and 2023.

A significant portion of this, $35 billion, has been earmarked for Egypt, highlighting the UAE’s strategic alignment with nations pivotal to regional stability and growth. Such substantial commitments signal a robust interest in not just immediate gains but also long-term partnerships across Africa.

The UAE is not alone in its pursuit of African investments; it faces competition from Saudi Arabia, Qatar, and China. Each nation aims to secure strategic influence and trade access to Africa’s burgeoning markets. This competitive environment has led to intensified infrastructure investments, with the UAE focusing on sectors that can provide immediate returns while building long-term relationships.

In 2020, the total trade volume between the UAE and key African countries, including Angola, Kenya, Nigeria, Ethiopia, South Africa, and Tanzania, exceeded $8 billion. This data reflects the significant economic ties that are being fortified, creating a conducive environment for future investments.

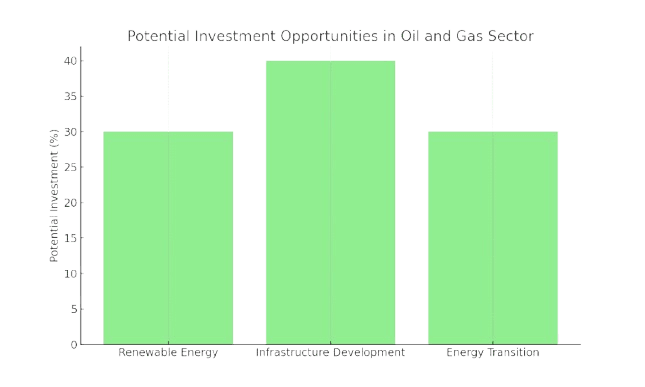

Given the growing interest from Gulf nations, particularly in renewable energy and infrastructure, there lies a unique opportunity for SHS to explore investments in the oil and gas sector. The strategic objectives of Gulf states to diversify their economies and reduce dependence on fossil fuels create openings in oil and gas, particularly in areas such as:

The increasing interest of UAE and Middle Eastern funds in Africa represents a substantial opportunity for entities like SHS to expand their investment footprint in the oil and gas sector. With strategic investments in infrastructure, renewable energy, and direct commitments to major projects, the Gulf states are shaping the future of African economies. By leveraging these dynamics, SHS can position itself advantageously within this growing market, ensuring sustainable and profitable investments that resonate with the continent’s development goals.